On January 22, my office hosted renowned economist and housing market specialist Matthew Gardner, who shared his 2025 Economic & Housing Market Forecast. We spent an hour listening to his keen analysis and insights, which included a look back at 2024, some discussion about what to expect with the new administration, and a look ahead to 2025 and beyond. Please let me know if you want to receive a link to the recording or a PDF of his PowerPoint slide deck.

He expertly broke down his presentation using a macro-to-micro approach, starting with the national economy and then narrowing down locally by presenting stats, figures, and predictions about the King and Snohomish County economies and housing markets. Here are my top takeaways.

✅ NATIONAL ECONOMY:

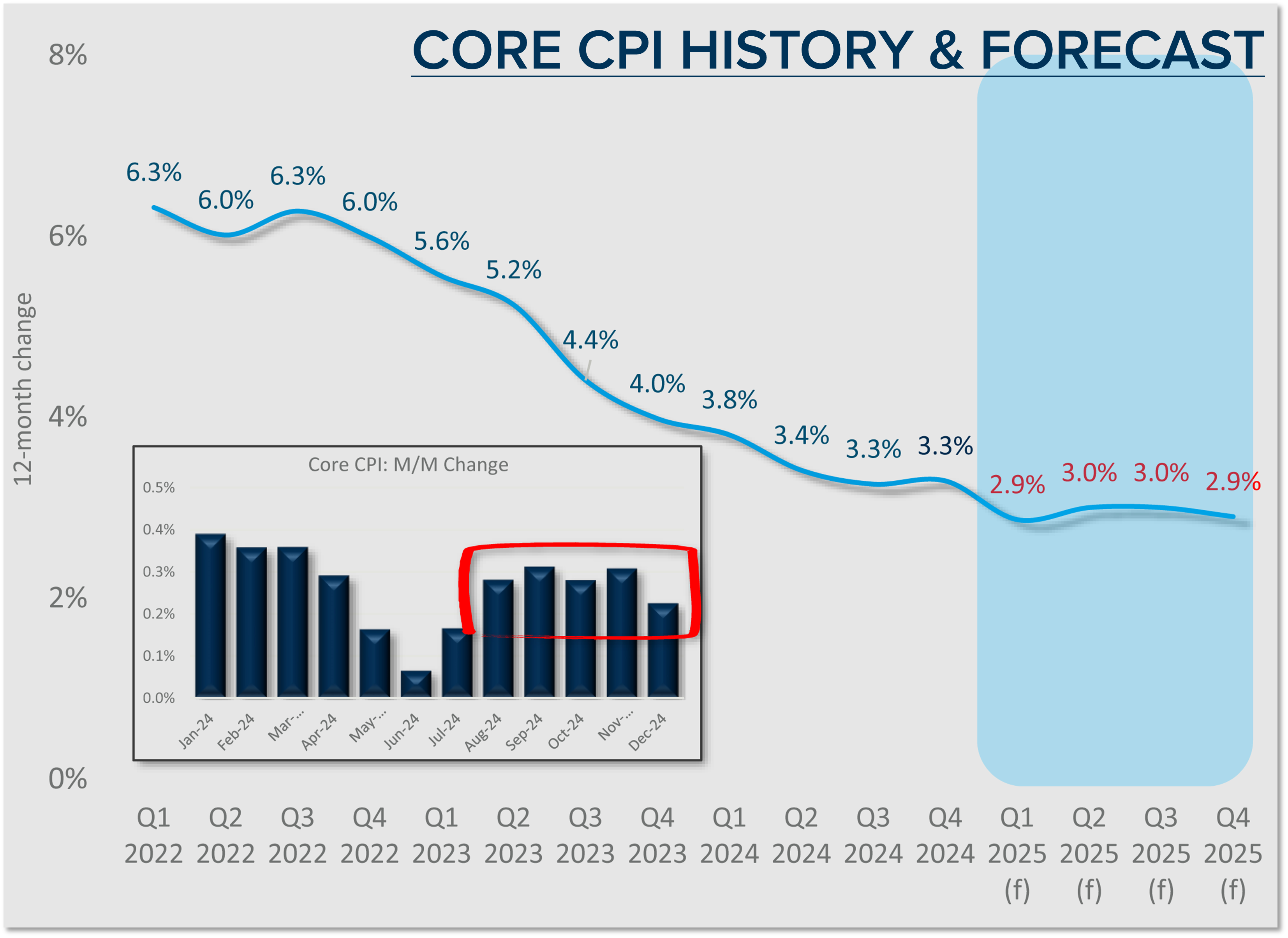

Inflation has become “sticky”! It slowly trended down in 2024 but could tread water in 2025, depending on what happens with tariffs under the new administration. If tariffs are instituted across the board, many countries are predicted to respond by implementing their own tariffs, which would increase the cost of goods.

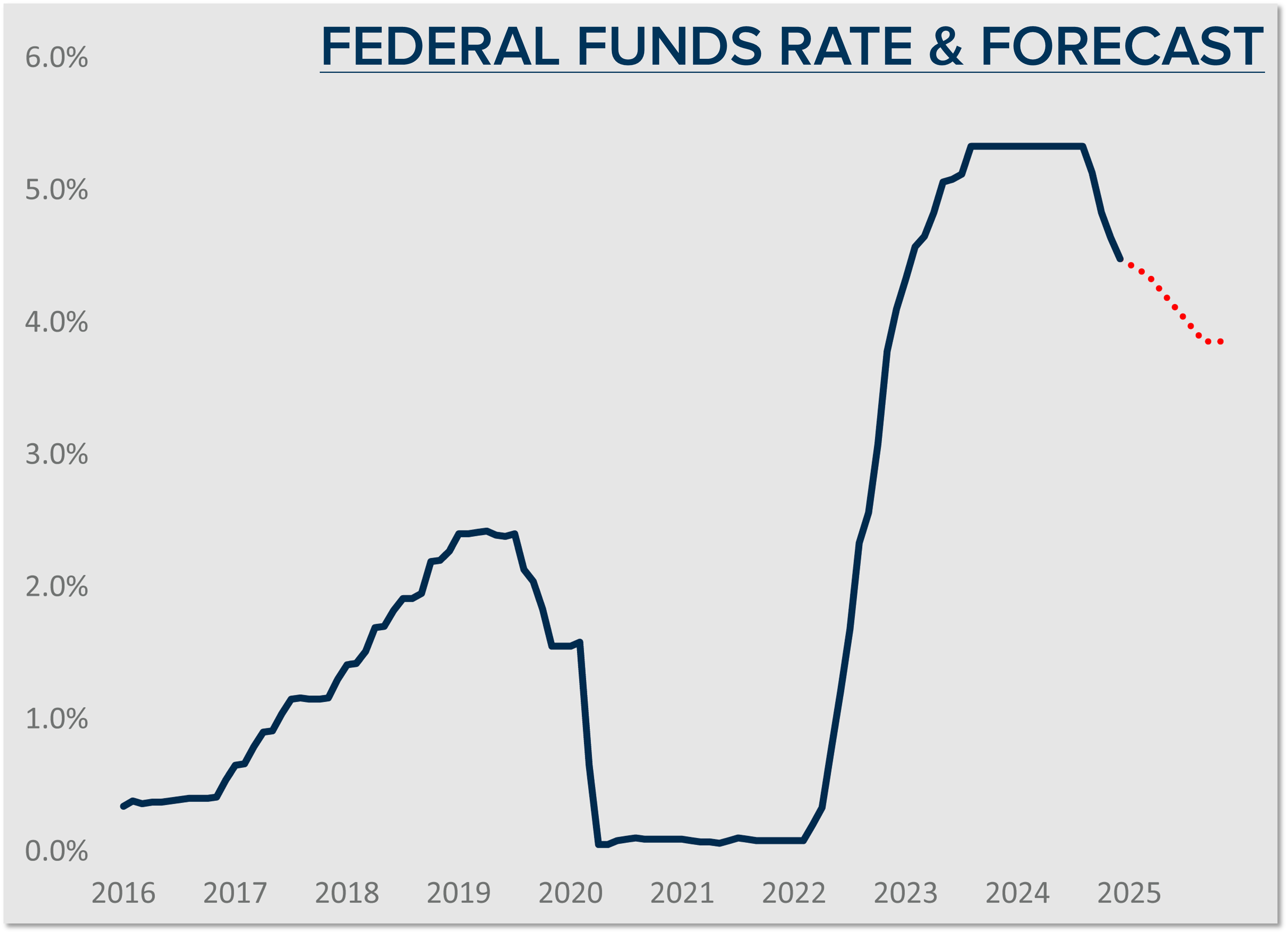

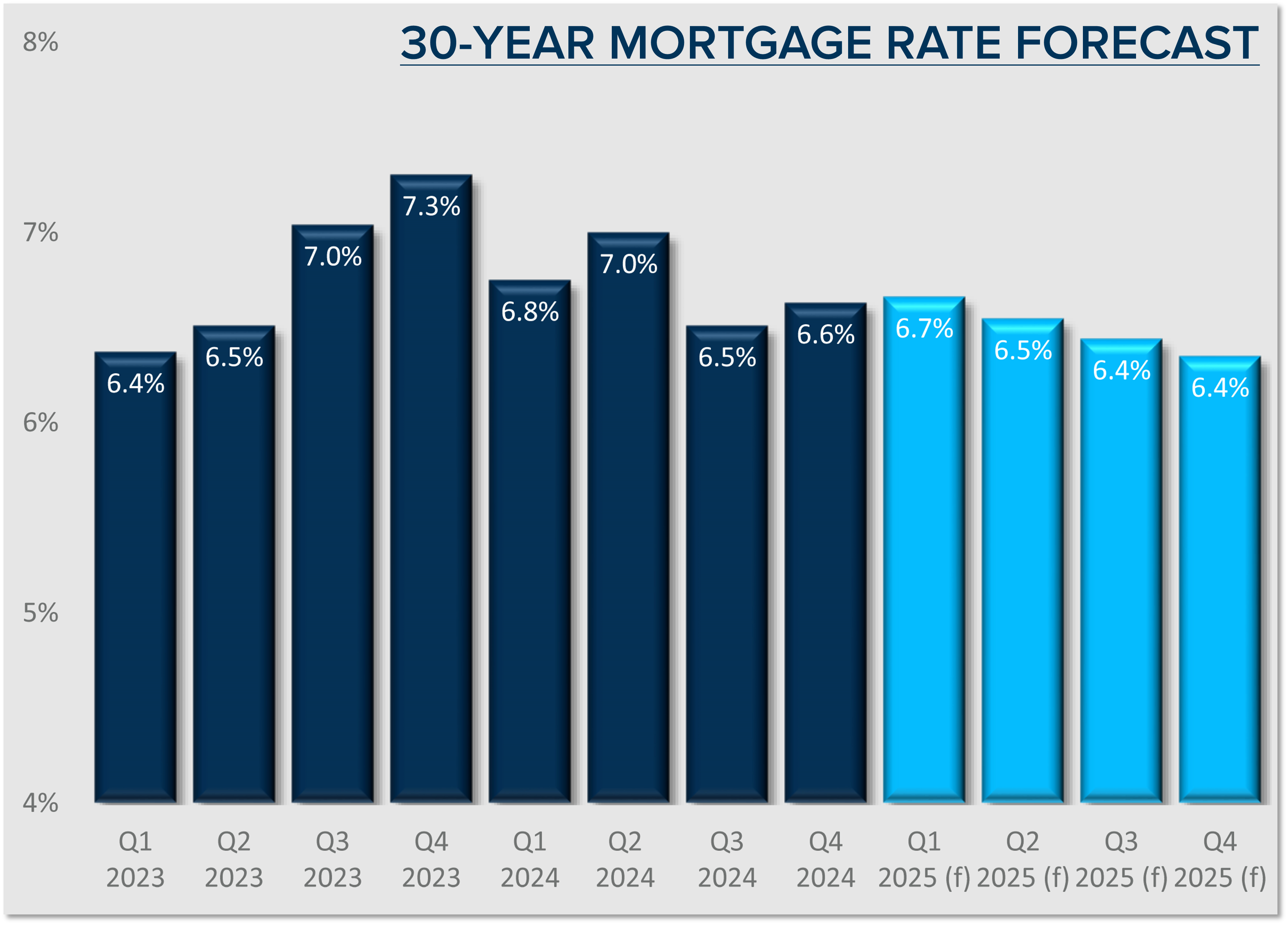

The Federal Funds Rate will slowly decrease over the course of 2025. Until we get clarity on proposed tariffs on U.S. trade partners, the Federal Reserve will remain aggressive with rates to combat inflation. The current consensus is for the Fed to make two rate cuts instead of four, with the first possibly being in February. NOTE: The Federal Funds Rate is the short-term interest rate (credit cards, car loans, etc.), not Mortgage Rates.

There is no sign of a recession. The balance of inflation, rates, and the overall health of the economy has created a soft landing that avoided a recession. In fact, GDP is up by 2% and the textbook definition of a recession is when the GDP decreases over two successive quarters.

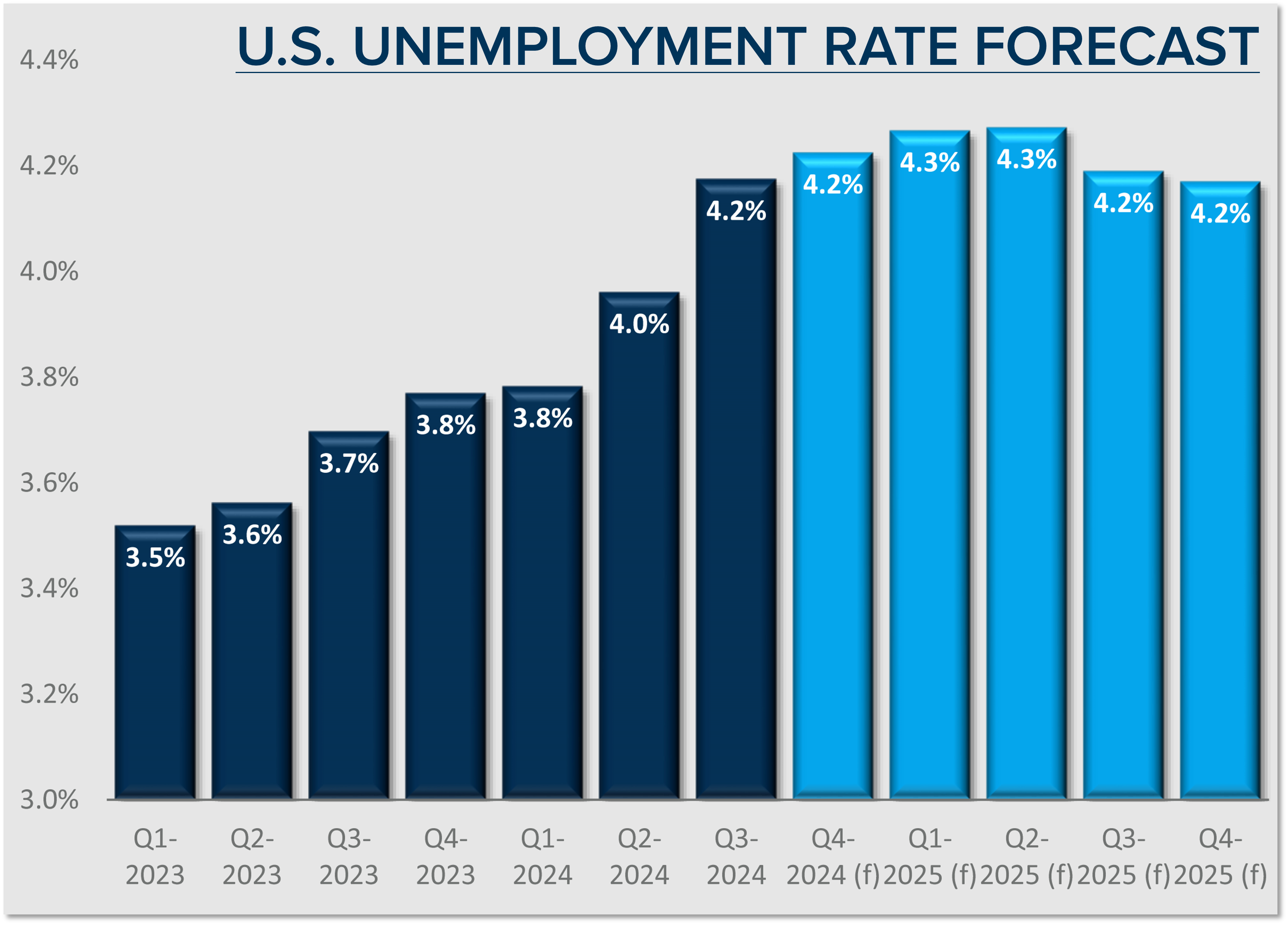

Tepid job growth in 2025. The labor market has cooled nationally after the “catch-up” period seen after the pandemic. Going forward, proposed immigration reform could weigh on labor force growth and hamper job creation. Weak labor force growth keeps the unemployment rate from rising in any meaningful way and is anticipated to peak around 4%.

✅ GREATER SEATTLE AREA JOB MARKET:

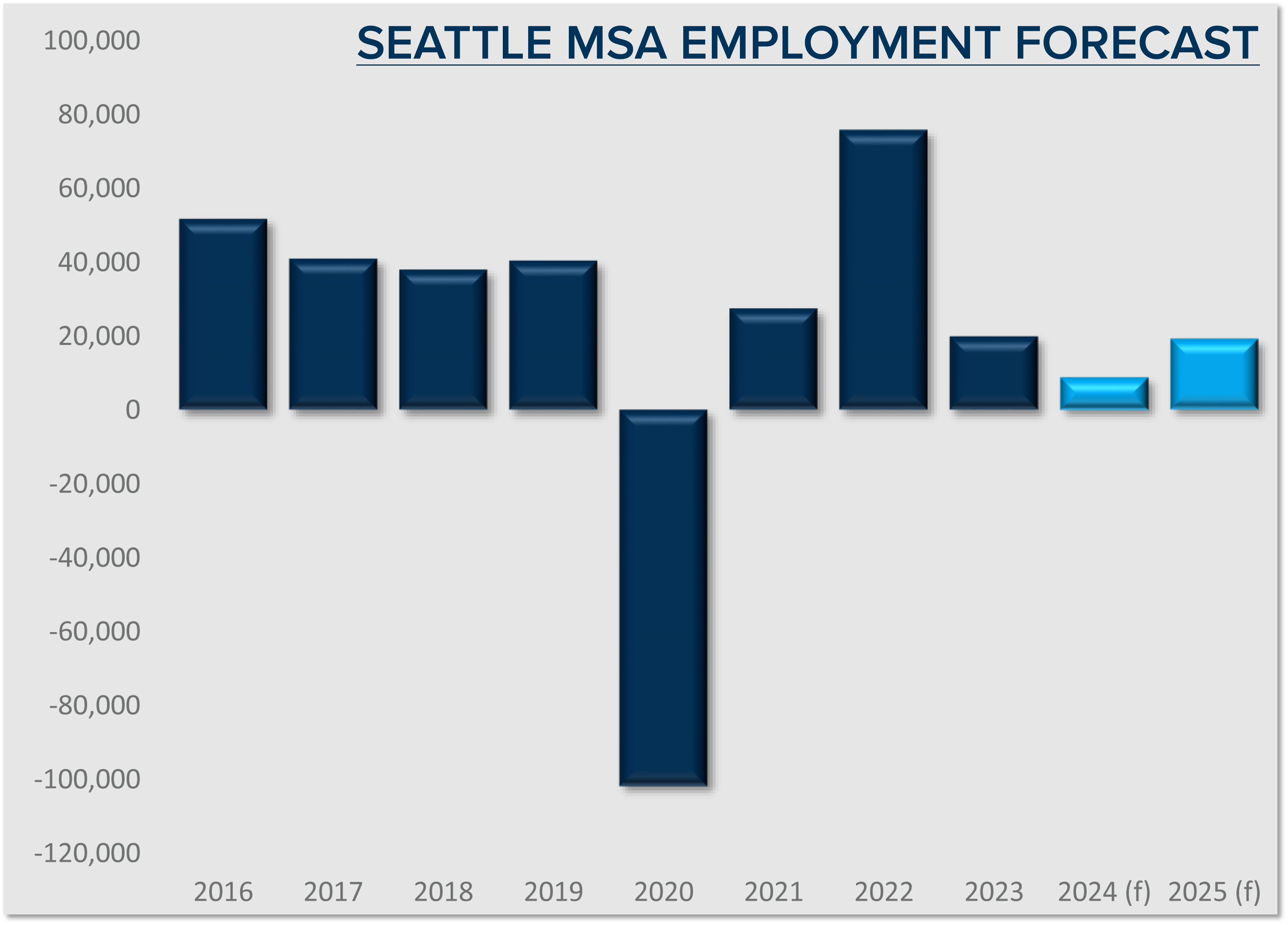

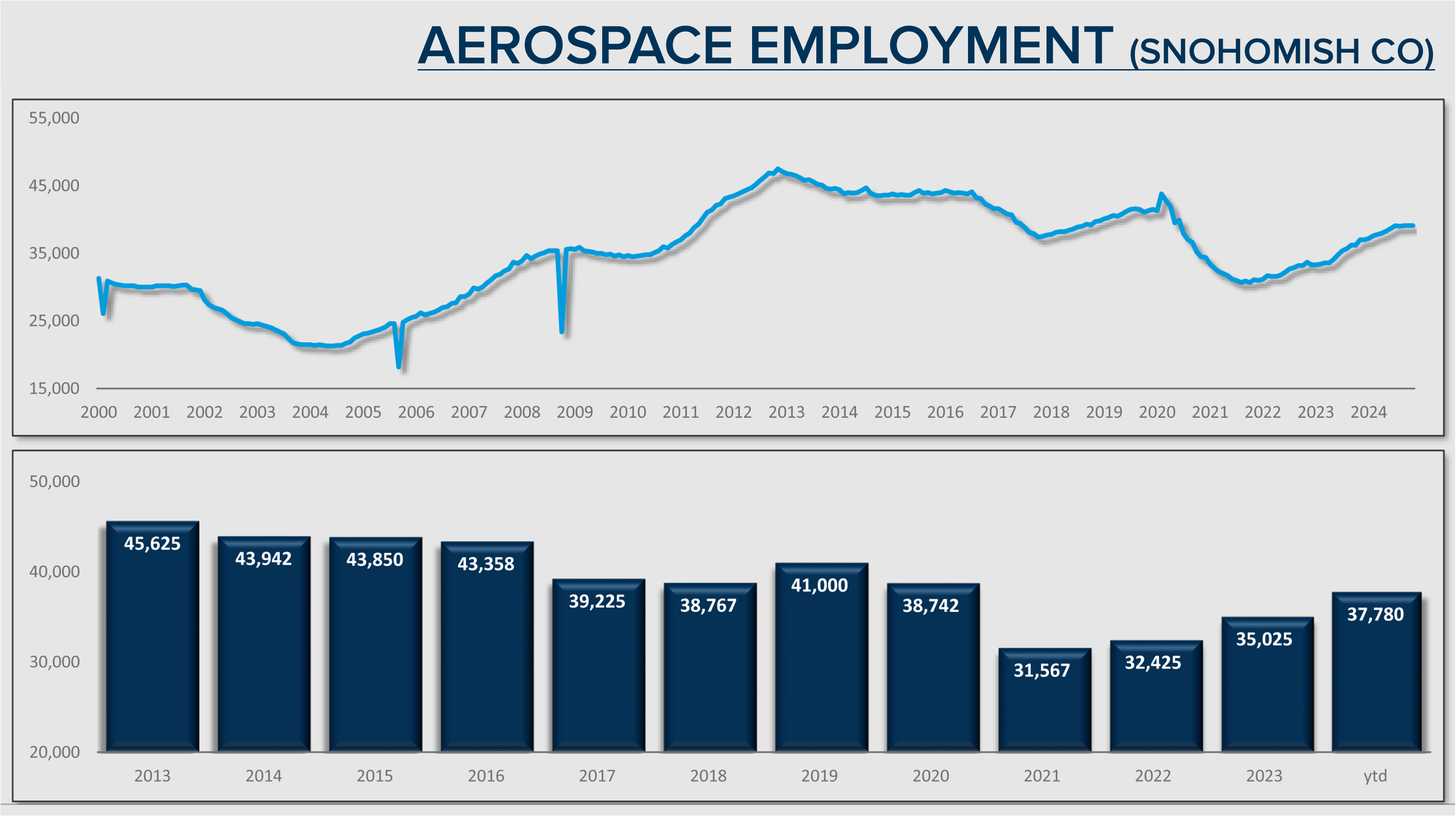

Job growth is still happening, yet ever so slightly! Jobs expanded by 1.2% in 2024 and should expand by 1.5% in 2025. The tech sector props up King County, and Snohomish County did have a relatively positive recovery post-Boeing strike. The construction sector is down, and some businesses will “wait and see” about growth once the administration starts to take shape with trade and immigration policies, which will directly affect labor costs.

✅ GREATER SEATTLE HOUSING MARKET:

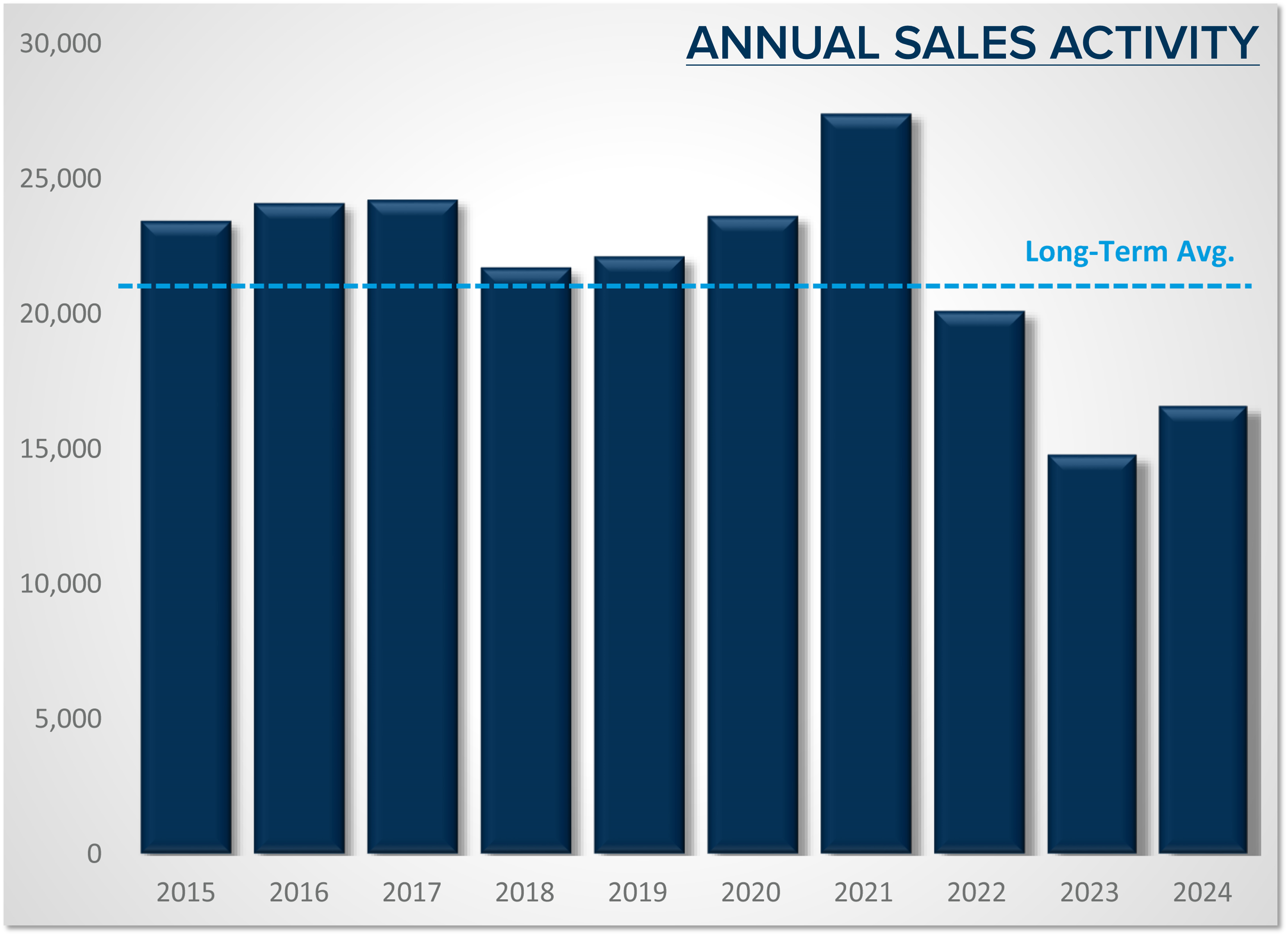

Inventory will increase in 2025 over 2024 by 8-10%. In 2024, inventory increased by 14% over 2023, which saw the lowest levels since the Great Recession. Lower inventory has been driven by the “lock-in” effect created by the previous low interest rates. Moves have been less discretionary and more so motivated by death, divorce, and diapers. More discretionary moves will happen when homeowners see mortgage rates closer to within 2% of their current rate. However, equity levels are high (over 50% of homeowners have 50% or more equity), enabling buyers who are also sellers to reposition their equity to a home that better fits their lifestyle, should the monthly payment work for them.

Mortgage rates will modestly decrease throughout 2025 and should end up in the low 6%. The biggest headwind is deficit spending now that inflation has settled. This spending will keep the 10-year treasury high, which will have a direct impact on mortgage rates. These are two key factors to watch if you’re waiting for mortgage rates to drop significantly.

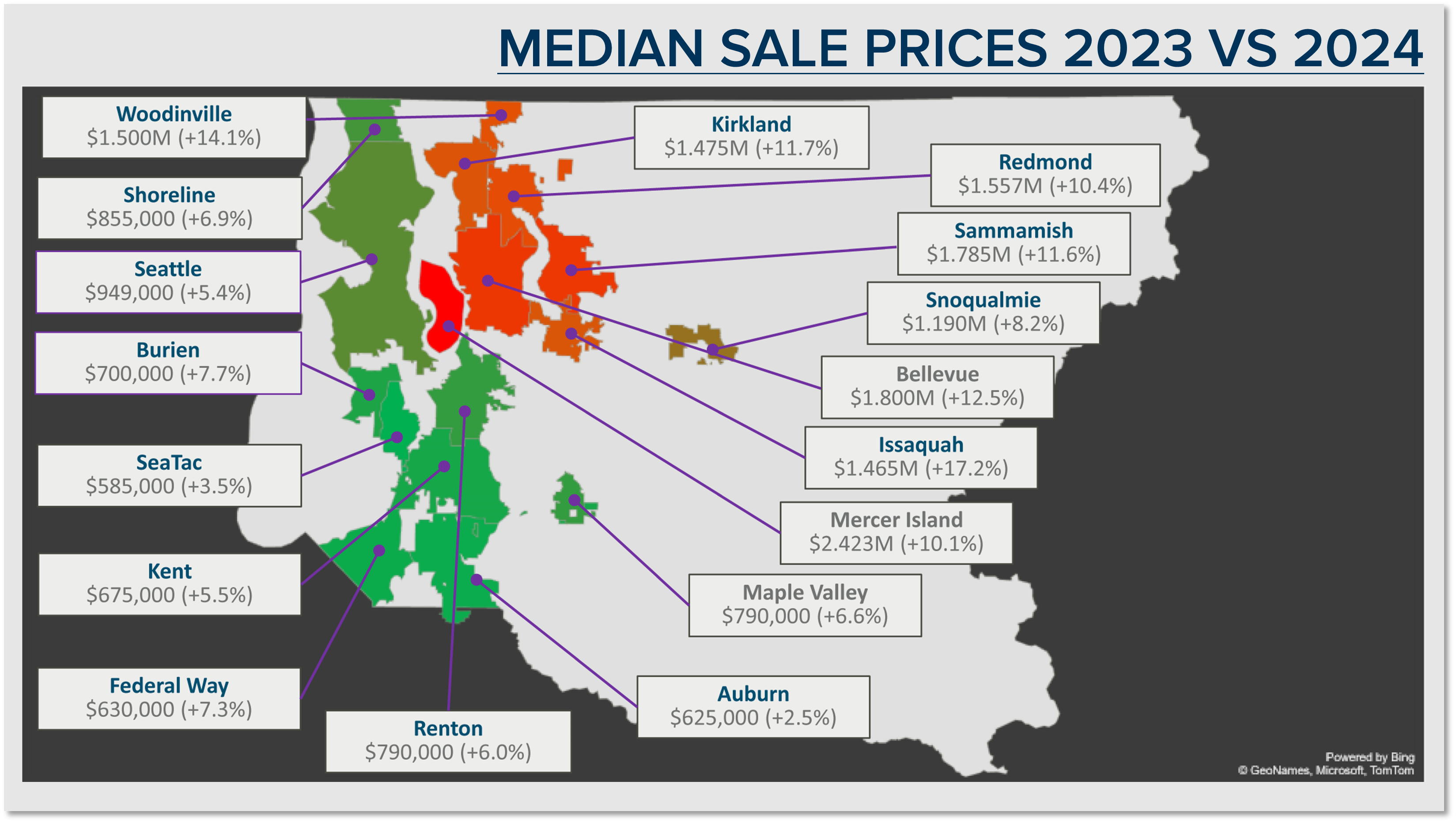

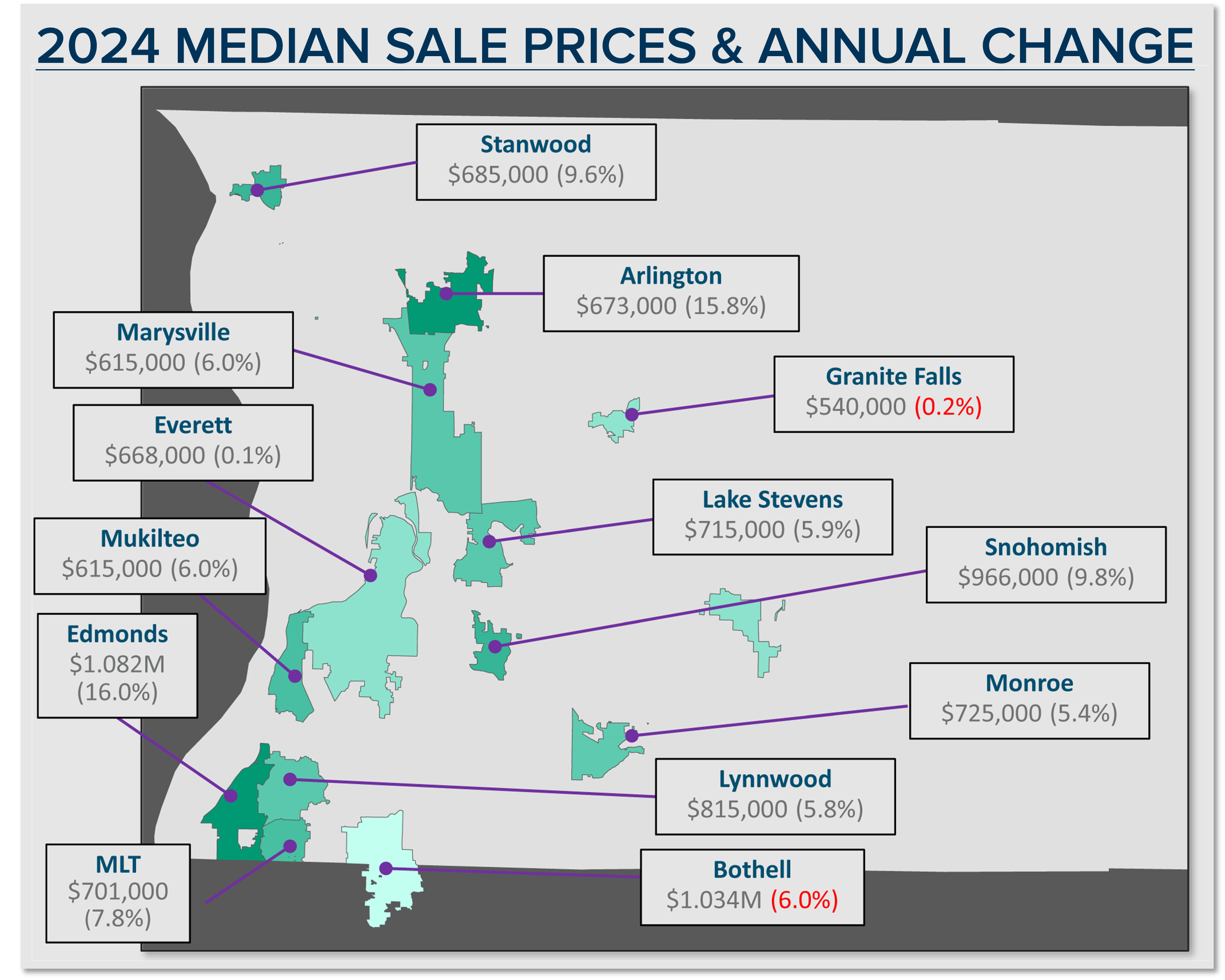

Prices increased in King and Snohomish counties in 2024 and are expected to grow again in 2025 despite stubborn mortgage rates. In King County, inventory was up by 10%, sales were up 12%, and the median price was up 10.7% year-over-year. Price growth is predicted to increase by 4% in 2025, which is higher than the historical national annual average. In Snohomish County, inventory was up by 17%, sales were up 8%, and the median price was up 9.9% year-over-year. Price growth is predicted to increase by 5% in 2025.

Affordability is the biggest challenge. With price growth steady coupled with higher interest rates, monthly payments have grown faster than incomes. This has put first-time homebuyers at a disadvantage in core job center locations. Down payment assistance (gift funds) from family and/or high-paying salaries in the tech, biotech, and big corporate companies have differentiated the ability of some first-time homebuyers compared to others with limited down payment funds and higher debt-to-income ratios.

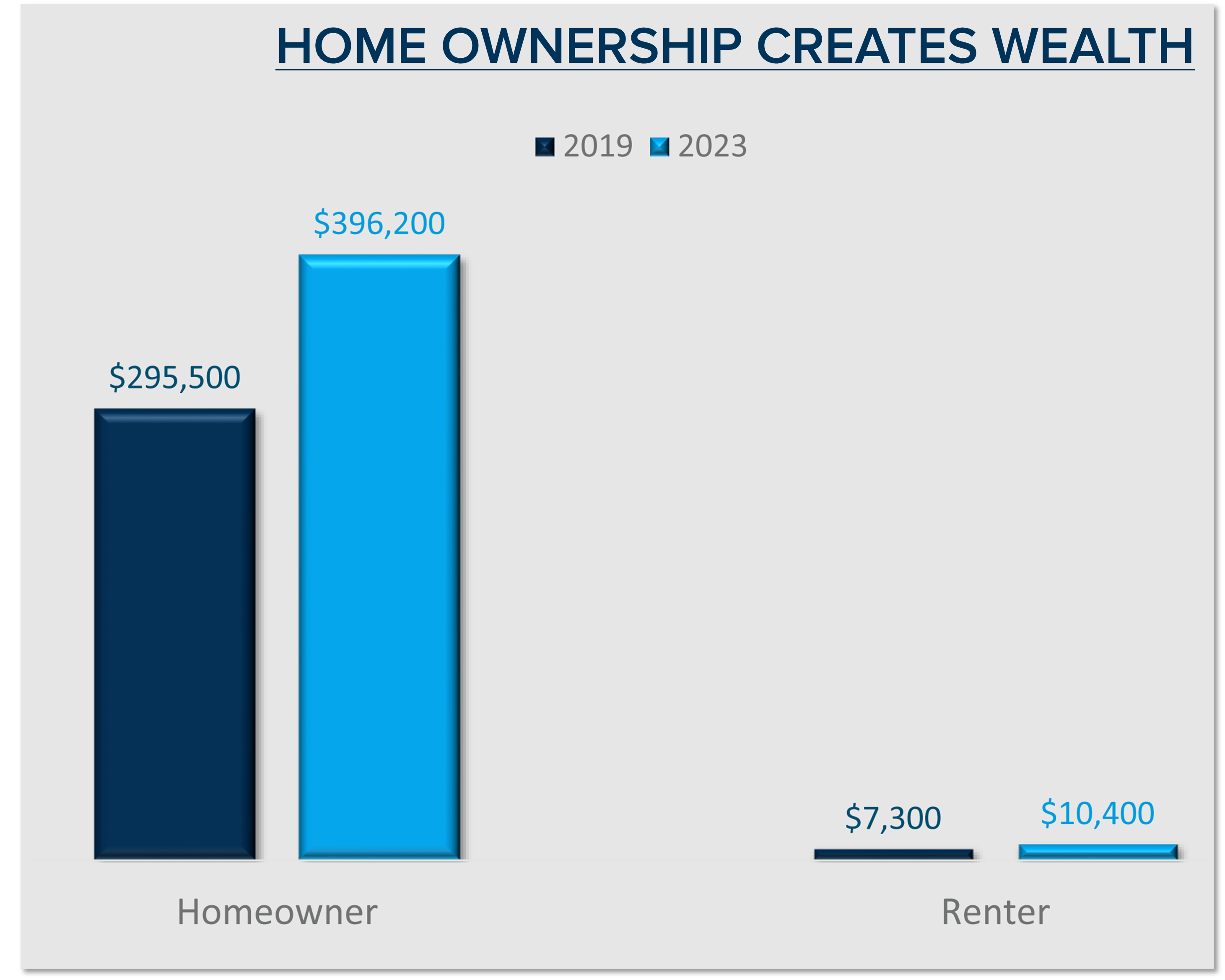

The American Dream is still alive! Homeownership has proven to be one of the strongest hedges against inflation and the single most lucrative wealth-building asset a household can have over time. A key piece of advice for first-time homebuyers would be to do what you can with what you have, which may mean buying a smaller property or going further out in location. Regardless of where one buys, this will put them on the trajectory of building household wealth through real estate and open up an opportunity to upgrade later. In fact, the net worth of a homeowner in 2023 was $396,200 vs. $10,400 of a renter.

This is certainly a lot to unpack as we head into 2025. Stay tuned for even more insights on what we learned from Matthew in my next newsletter. In the meantime, I am here to encourage you and point out that this is a lot of good news. We look forward to more moderate growth in 2025, which is good. Severe increases are not healthy. While we are combating an affordability crisis, the steady wave of moderation on top of incredibly high equity levels should play out to create a stable and fruitful 2025 real estate market.

If you are curious about how all of this relates to your real estate goals or you know someone that needs some guidance, please reach out. I will continue to help keep you well informed so you can be empowered to make strong decisions.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link